The Wild Western Interconnection: How the old school power grid is quickly developing advanced markets

Classic bilateral transactions and relationships are rapidly shifting to market-based solutions

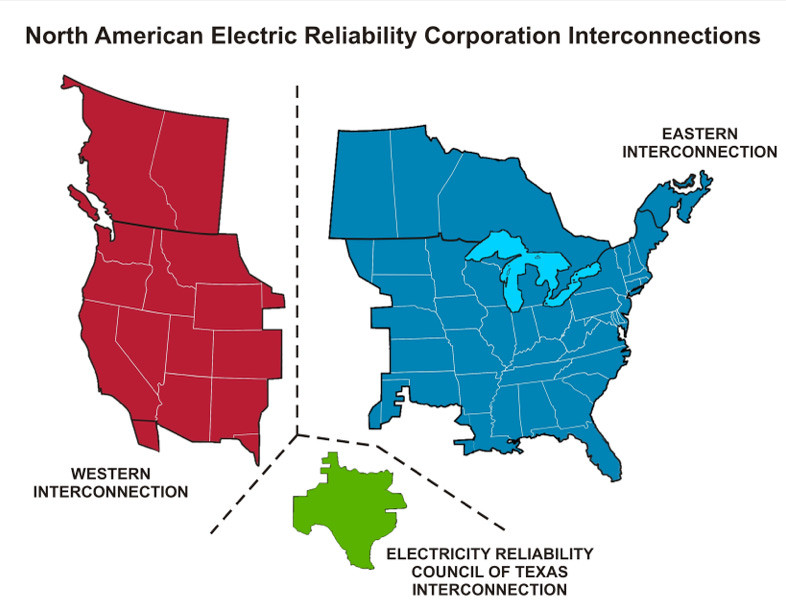

The Western Interconnection (WI) is the electrical grid covering everything west of the Great Plains. It’s often viewed incorrectly as a homogenous zone relative to the larger and diverse Eastern Interconnection (EI), which blankets 2/3rds of the country. Tethered to the EI by just eight high voltage DC ties, the western grid operated largely in obscurity for decades. That’s rapidly changing.

Business between utilities in the 20th century consisted of bilateral transactions. Energy is traded on an hourly-basis with 24 trading hours in a day. If a utility required power for the next hour, the solutions were to turn on another generator, or purchase excess from another utility “bilaterally” at a fixed price. Every utilities’ goal is to match supply with demand for their systems. This is how it was done for decades.

Going into the 21st century, real-time organized wholesale electricity markets began to develop. Utilities joined together to create markets to unlock comparative advantages. In doing so, greater efficiencies were captured. Operators no longer had to run their expensive units. Instead, the cheapest units in the market ran, saving on fuel costs for everyone in the power pool.

These real-time markets morphed into next-day variants, a core function of a Regional Transmission Organization (RTO). A centralized operator, like Southwest Power Pool (SPP), which is an RTO, could then coordinate into the next day what units to run based on the lowest costs. This further unlocked more savings and value for the utilities in the Eastern Interconnection. These markets developed in the mid-2000s and by the mid-2010s, had encompassed much of the eastern grid.

Business in the West in the early 21st century remained largely “old school.” There were no markets outside of California, which has always gone its own way from its peers. Some real-time

operators in Wyoming and Colorado weren’t even aware of power markets in Nebraska or Kansas until 3-4 years ago. The separate grids created a physical boundary blockading business relationships from ever developing.

California’s market is called CAISO. In 2014, CAISO began expanding its market services to outside utilities in other states to participate. Gradually, more signed on. Things really accelerated in January 2018 when CAISO announced they would become their own Reliability Coordinator (RC). An RC is charged with the highest authority over real-time operations ensuring reliability over the grid. PEAK had been the Western Interconnection’s RC since 2014 (and WECC before that). With this development, Southwest Power Pool, the Great Plains RTO on the other side of the physical grid boundary, also moved in. California and SPP split the baby and became RCs for utilities in the West. PEAK dissolved operations on December 3, 2019.

During 2018, CAISO and SPP moved aggressively and competitively to pitch markets to the western utilities. CAISO’s head start in 2014 gave them a leg-up. SPP recruited a cluster of utilities in the eastern Rockies. Within a short time, companies who had done business bilaterally for decades were suddenly introduced to real-time imbalance markets. And they’re just getting started.

The Eastern Interconnection has multiple RTOs with the templates already there. The reasons for advancing into these markets is the cost savings and efficiencies realized. Integrated markets are also seen as solutions for more rapid adoption of renewables. Without a centralized dispatching authority, managing a large number of wind turbines is impossible for independent utilities. RTOs have proven very capable in that regard.

The problems of an RTO are numerous. Autonomy by utilities is given up when joining an RTO. Decisions are made by the group you are in. A big fish in their own pond has a hard time acclimating to a different pool with diverse and often smaller players who have equal voices. Costs are now shared amongst the members, which creates winners and losers in some circumstances. An RTO is a family where everyone needs to find a way to get along.

In June 2021, Colorado and Nevada passed legislation for transmission-owning utilities to join RTOs by 2030. Many states and companies have decarbonization goals to meet in the decades to come. The largest coal deposits are also found in Wyoming’s Powder River Basin. Political interests may divide and clash with some of these mandates.

Regardless, the clock is ticking. SPP and CAISO are both trying to secure as much market share as they can creating a viable RTO. Whether we get one or two is left to be seen; however, it’s certain to happen. What was once the Wild West when it came to trading has accelerated rapidly unifying the grid into organized markets. The Western Interconnection in 2021 is the most dynamic place to be.